Bayer: Solid performance despite COVID-19 impact

- Ensuring employee safety and maintaining supply chains remain top priorities

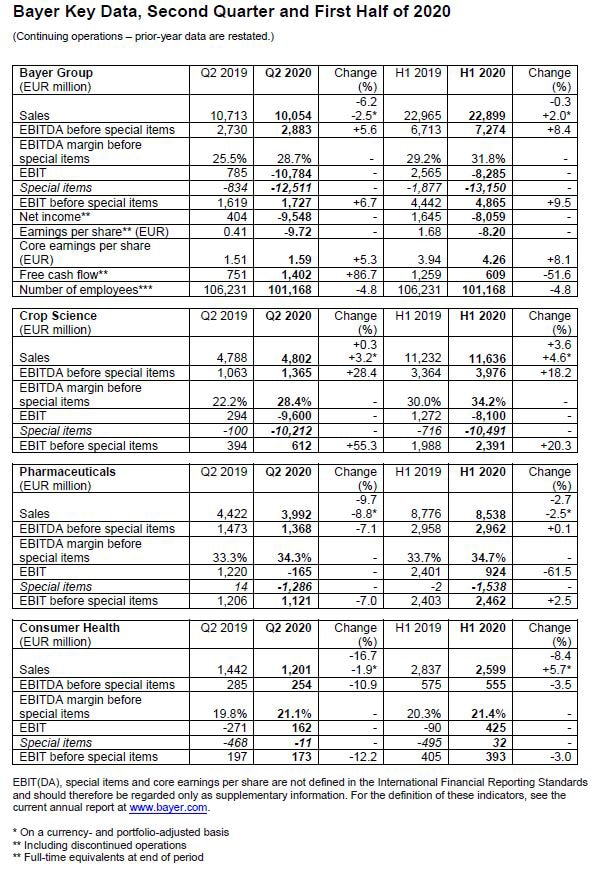

- Group sales decline by 2.5 percent (Fx & portfolio adj.) to 10.054 billion euros

- EBITDA before special items up 5.6 percent to 2.883 billion euros

- Crop Science reports operational growth

- Sales and earnings at Pharmaceuticals down mainly due to volume-based procurement policy in China and COVID-19

- Sales at Consumer Health decline slightly (Fx & portfolio adj.) after strong demand in first quarter

- Net loss of 9.548 billion euros due to special items for litigations – agreements in major legacy Monsanto litigation

- Core earnings per share increase by 5.3 percent to 1.59 euros

- Free cash flow rises to 1.402 billion euros

- Outlook adjusted for COVID-19 impact

Leverkusen, August 4, 2020 – The Bayer Group’s businesses turned in a solid performance in the second quarter of 2020 despite the COVID-19 pandemic and the associated uncertainties. “Thanks to the growth in our agricultural business, we raised EBITDA before special items – and we did so in a challenging environment,” said Werner Baumann, Chairman of the Board of Management, when the half-year financial report was released on Tuesday. Sales in the Pharmaceuticals and Consumer Health divisions receded, however. “Our primary aim during the coronavirus pandemic remains the safety and wellbeing of our employees and the society in which we live and work,” Baumann pointed out. He said Bayer is also taking the necessary steps to safeguard the continuity of business operations in these challenging times and ensure reliable supplies of its products and services to hospitals, physicians, patients, consumers and farmers. Bayer has adjusted its forecast for the current fiscal year because of the pandemic.

The second quarter of 2020 was also marked by the litigations in the United States. The company announced on June 24, 2020, that it had reached agreements in the product liability litigation concerning Roundup™ (active ingredient: glyphosate). The agreements contain no admission of liability or wrongdoing. The total costs to settle the approximately 125,000 filed and unfiled glyphosate claims and support a class settlement agreement to manage and resolve potential future Roundup™ litigation are currently expected to be up to 10.9 billion U.S. dollars. On July 6, 2020, Judge Chhabria of the U.S. District Court for the Northern District of California, who must approve the class agreement, raised concerns about certain aspects of the proposed agreement. Thereupon, the parties decided to withdraw their motion in order to comprehensively address the court’s questions. Bayer remains strongly committed to a resolution that simultaneously addresses the current litigation on reasonable terms and provides a viable solution to manage and resolve potential future litigation.

On July 20, 2020, the California Court of Appeal affirmed the judgment in favor of Dewayne Johnson, one of the three cases continuing through the appeals process, but reduced the total judgment from 78.5 million U.S. dollars to approximately 20.5 million U.S. dollars. The company will consider its legal options, including an appeal to the Supreme Court of California. Settlement agreements were also reached in the dicamba drift litigation and for most of the PCB (polychlorinated biphenyls) water litigation.

Discussions on potential settlements in connection with Essure™, a medical device offering permanent birth control with a nonsurgical procedure, recently intensified and have made good progress in recent weeks. Bayer therefore established appropriate provisions in the second quarter. The Pharmaceuticals Division recorded special charges of 1.245 billion euros for litigations, primarily for Essure™.

Increase in core earnings per share from continuing operations

Group sales in the second quarter of 2020 declined by 2.5 percent on a currency- and portfolio-adjusted basis (Fx & portfolio adj.) to 10.054 billion euros. Group EBITDA before special items rose by 5.6 percent to 2.883 billion euros, net of 12 million euros in negative currency effects. EBIT of the Bayer Group was minus 10.784 billion euros (Q2 2019: plus 785 million euros) after net special charges of 12.511 billion euros (Q2 2019: 834 million euros). The special charges mainly comprised provisions for the agreements reached with regard to glyphosate, dicamba and PCBs. Other special charges resulted from expenses for litigations at Pharmaceuticals, mainly in connection with Essure™, and from the ongoing restructuring program. The Group posted a net loss of 9.548 billion euros (Q2 2019: net income of 404 million euros). Core earnings per share from continuing operations rose by 5.3 percent to 1.59 euros.

The free cash flow amounted to 1.402 billion euros (Q2 2019: 751 million euros). Net financial debt increased by 1.7 percent compared with March 31, 2020, to 35.993 billion euros as of June 30, 2020, with cash inflows from operating activities and positive currency effects largely offsetting the disbursements for the dividend payment.

Crop Science posts growth in three out of four regions

In the agricultural business (Crop Science), Bayer raised sales by 3.2 percent (Fx & portfolio adj.) to 4.802 billion euros, with the Latin America, Asia/Pacific and North America regions contributing to the increase. The division achieved 2.7 percent higher sales (Fx & portfolio adj.) at Corn Seed & Traits, mainly due to significant volume expansion in Brazil. Sales at Herbicides increased by 3.3 percent (Fx & portfolio adj.) thanks to higher volumes and advance purchases in Latin America coupled with substantial business growth in North America. Sales at Soybean Seeds & Traits showed particularly strong growth of 9.3 percent (Fx & portfolio adj.), with business recovering in North America thanks to an increase in acreages and to shifts in demand from the first quarter arising from uncertainties over COVID-19. In Latin America, an increase in market share had a positive effect. Sales at Insecticides rose by 4.5 percent (Fx & portfolio adj.), driven by gains in the Latin America and Asia/Pacific regions. By contrast, declines were primarily recorded at Vegetable Seeds (Fx & portfolio adj. minus 5.0 percent). Sales were down mainly in North America, where business was adversely impacted by shifts in demand into subsequent quarters and the COVID-19 pandemic.

EBITDA before special items at Crop Science advanced by 28.4 percent to 1.365 billion euros. The increase was primarily due to the accelerated realization of cost synergies as Bayer progresses with the integration of the acquired businesses, as well as to higher volumes.

Pharmaceuticals weighed down by COVID-19 and volume-based procurement policy in China

Sales at Pharmaceuticals declined by 8.8 percent (Fx & portfolio adj.) to 3.992 billion euros. The contact restrictions and protective measures introduced worldwide due to the COVID-19 pandemic led to a drop in elective treatments in doctors’ offices and hospitals, with some treatments being postponed. This particularly affected women’s health, ophthalmology and radiology products. There was nevertheless a slight recovery trend toward the end of the second quarter. In China, business was again held back by the implementation of a new volume-based procurement policy that involves substantial price reductions for off-patent products.

Bayer raised sales of the oral anticoagulant Xarelto™ by 6.8 percent (Fx & portfolio adj.), largely as a result of higher volumes in China, Russia and Germany. Particularly strong gains were recorded for the cancer drug Stivarga™ (Fx & portfolio adj. plus 24.8 percent) and the pulmonary hypertension treatment Adempas™ (Fx & portfolio adj. plus 23.6 percent), with increased demand for both products, especially in the United States. Sales of Stivarga™ also rose in China. Business benefited from the product’s oral formulation, which enables treatment to continue outside of hospitals and doctors’ offices.

Sales of the eye medicine Eylea™ were down by 6.4 percent due to a reduced number of treatments. This development was partly offset by the launch of the Eylea™ prefilled syringe in Europe and Japan and an overall volume increase in Japan. The pandemic also led to a particularly marked drop in sales of Mirena™/Kyleena™/Jaydess™ intrauterine systems (Fx & portfolio adj. minus 37.0 percent). Product insertions declined substantially, especially in the United States, with many visits to the doctor canceled or postponed. Sales of the diabetes treatment Glucobay™ fell by 73.8 percent – mainly due to the implementation of the volume-based procurement policy in China. This involves a substantial price reduction that cannot be offset by the resulting growth in volumes.

EBITDA before special items at Pharmaceuticals decreased by 7.1 percent to 1.368 billion euros, primarily as a result of the decline in sales.

Slight sales decrease (Fx & portfolio adj.) at Consumer Health

Sales of self-care products (Consumer Health) declined by 1.9 percent (Fx & portfolio adj.) to 1.201 billion euros. After a very strong first quarter, the second quarter brought destocking by retailers and consumers, as expected. The decline was also driven by the quarantine and protective measures introduced in various regions leading to less in-store retail traffic. The Nutritionals category saw the largest increase (Fx & portfolio adj. plus 14.4 percent) and the Allergy & Cold category the largest decrease (Fx & portfolio adj. minus 17.2 percent).

EBITDA before special items at Consumer Health declined by 10.9 percent to 254 million euros, primarily due to lower volumes as a result of COVID-19 and the absence of net earnings of around 35 million euros from the businesses divested in 2019.

Outlook for 2020 adjusted

The financial impact of the COVID-19 pandemic remains difficult to predict. Bayer is therefore adjusting the forecast issued in February 2020 as follows, based on the business development in the first half of the year and assumptions for the rest of the year that involve uncertainties: The company anticipates that business at Pharmaceuticals and Consumer Health will normalize overall, although the growth originally envisaged for Pharmaceuticals is not expected to be achieved. For the Crop Science Division it foresees a restrained start in the fourth quarter to the 2021 North America season as a result of pandemic-related reduced demand for biofuel, feed and fiber driving an expected reduction in 2021 planted acres, as well as from ongoing soy market dynamics.

This results in the following changes for the Bayer Group’s financial indicators. The company is now targeting currency-adjusted growth in sales to between 43 and 44 billion euros (previously: to between 44 and 45 billion euros). This corresponds to an increase of 0 to 1 percent (previously: about 3 to 4 percent) on a currency- and portfolio-adjusted basis. It remains the aim to increase the EBITDA margin before special items to around 28 percent on a currency-adjusted basis. Based on the sales target, this would correspond to EBITDA before special items of around 12.1 billion euros (previously: 12.3 to 12.6 billion euros) on a currency-adjusted basis. Core earnings per share are now predicted to rise to between 6.70 and 6.90 euros (previously: to between 7.00 and 7.20 euros) on a currency-adjusted basis.

Bayer also expects to register substantial negative currency effects, primarily due to the depreciation of the Brazilian real. Based on the June 30, 2020, exchange rates, the company now expects to post Group sales of between 42 and 43 billion euros, an EBITDA margin before special items of 28 percent, and core earnings per share of between 6.40 and 6.60 euros for 2020.

In addition, the company now expects that payments to resolve litigations will diminish the free cash flow by an amount of 4.5 billion euros that did not yet feature in the original planning and is to be regarded as extraordinary and nonrecurring. The free cash flow is now forecast at between minus 0.5 billion euros and zero. Taking into account the financing of the litigation payments, Bayer now only expects to reduce net financial debt to around 33 billion euros (previously: to about 27 billion euros). Changes in exchange rates are not expected to have any material impact on the free cash flow or net financial debt.

For more information go to www.bayer.com.

Forward-Looking Statements

This release may contain forward-looking statements based on current assumptions and forecasts made by Bayer management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Bayer’s public reports which are available on the Bayer website at www.bayer.com. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.