Bayer on track in operational business

-

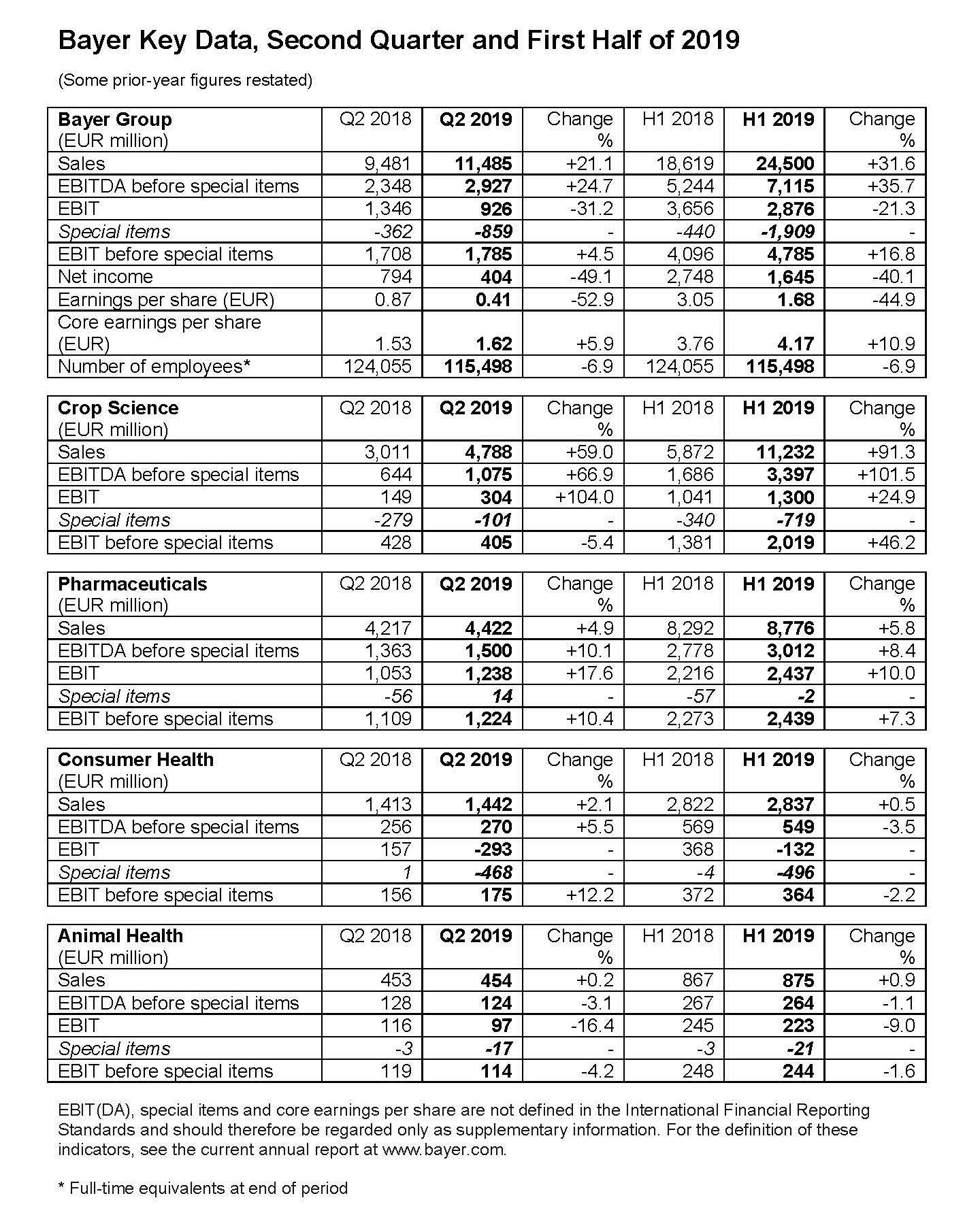

Group sales increase by 0.9 percent (Fx & portfolio adj.) to 11.485 billion euros

-

EBITDA before special items advances by 24.7 percent to 2.927 billion euros

-

Crop Science sees sales decline (Fx & portfolio adj. and pro forma) in challenging environment but posts substantial earnings growth due to acquired business

-

Pharmaceuticals posts higher sales and strong earnings growth

-

Consumer Health increases sales and earnings

-

Net income falls by 49.1 percent to 404 million euros, held back by special items for restructuring and impairments

-

Core earnings per share increase by 5.9 percent to 1.62 euros

-

Group outlook confirmed yet increasingly ambitious

Leverkusen, July 30, 2019 – The Bayer Group continued to grow in the second quarter of 2019. “Bayer is on track in its operational business,” said Werner Baumann, Chairman of the Board of Management, when presenting the half-year financial report on Tuesday. “Sales at Crop Science were primarily held back by the extreme weather conditions in North America, while at Pharmaceuticals we recorded encouraging growth,” he said. Business was also up at the Consumer Health Division. Baumann confirmed the Group outlook for 2019, but noted that it was becoming increasingly ambitious.

Sales of the Bayer Group rose by 0.9 percent on a currency- and portfolio-adjusted basis (Fx & portfolio adj.) to 11.485 billion euros in the second quarter. On a reported basis, sales were up by a substantial 21.1 percent. EBITDA before special items increased by 24.7 percent to 2.927 billion euros. Negative currency effects arising primarily from hedging diminished earnings by 59 million euros compared with the previous year. EBIT declined by 31.2 percent to 926 million euros after net special charges of 859 million euros (Q2 2018: 362 million euros). The special charges mainly comprised impairment losses in connection with the agreed divestment of Dr. Scholl’s™ and expenses related to the announced restructuring measures.

Net income declined by 49.1 percent to 404 million euros. By contrast, core earnings per share from continuing operations rose by 5.9 percent to 1.62 euros. Free cash flow amounted to 751 million euros, down by 60.8 percent. This significant decline is due to the seasonality of the newly acquired Crop Science business. Since the acquisition closed in June 2018, the high cash outflows in April and May 2018 were not taken into account. Net financial debt as of June 30, 2019, increased to 38.808 billion euros, up 5.6 percent from March 31, 2019, due mainly to the dividend payment.

Crop Science impacted by extreme weather conditions

In the agriculture business (Crop Science), Bayer generated sales of 4.788 billion euros. On a reported basis, sales were up by 59.0 percent, thanks mainly to the acquisition of Monsanto. Overall, business at Crop Science in the second quarter was significantly impacted by extreme weather conditions. In particular, flooding and heavy rains in the Midwestern United States and drought in large parts of Europe and in Canada had a negative effect. Ongoing trade disputes also weighed on business. Sales were down by 3.1 percent after adjusting for currency and portfolio effects, with the development of the acquired business only taken into account for the period June 7 to June 30. This decline was mainly the result of a considerable drop in sales in North America. Significant sales gains in Latin America did not offset this effect.

On a pro-forma basis, sales of Crop Science declined by a currency-adjusted (Fx adj.) 9.9 percent. In this context, sales are presented as if the acquisition of Monsanto and the associated divestments had already taken place as of January 1, 2018. On this basis, business was down at Soybean Seed & Traits, Herbicides and Corn Seed & Traits in particular. By contrast, sales increased at Insecticides.

EBITDA before special items of Crop Science rose by 66.9 percent to 1.075 billion euros. The increase was largely attributable to the earnings contribution from the acquired business. Earnings were diminished by the decline in sales, the absence of the earnings contribution from the businesses divested to BASF, inventory write-downs and a negative currency effect of 26 million euros.

As of July 11, 2019, lawsuits from approximately 18,400 plaintiffs had been served in the United States in connection with the crop protection product glyphosate. Bayer continues to believe that it has meritorious defenses and intends to defend itself vigorously in all of these lawsuits. In parallel to the continued litigation, Bayer will constructively engage in the mediation process ordered by a district judge in California.

Pharmaceuticals posts strong earnings growth

Sales of prescription medicines (Pharmaceuticals) rose by 3.9 percent (Fx & portfolio adj.) to 4.422 billion euros. Business in China remained strong, and Bayer also continued to achieve robust growth with the oral anticoagulant Xarelto™ and the eye medicine Eylea™. Sales of Xarelto™ advanced by 12.5 percent (Fx & portfolio adj.), primarily due to expanded volumes in China and Europe/Middle East/Africa. License revenues – recognized as sales – in the United States, where Xarelto™ is marketed by a subsidiary of Johnson & Johnson, were down year on year. Sales of Eylea™ increased by 11.2 percent (Fx & portfolio adj.), with business continuing to expand in all regions.

Sales of the cancer drug Stivarga™ advanced by 23.9 percent (Fx & portfolio adj.), primarily as a result of higher volumes in China and Russia. With growth of 11.0 percent (Fx & portfolio adj.), sales of the pulmonary hypertension treatment Adempas™ also increased by a double digit percentage, driven by business in the United States and Europe. By contrast, business with the multiple sclerosis treatment Betaferon™/ Betaseron™ continued to decline. Sales were down by 17.9 percent (Fx & portfolio adj.), primarily as a result of strong competition in the United States. The 9.4 percent decrease (Fx & portfolio adj.) in sales of the cancer drug Nexavar™ was mainly due to the competitive market environments in the United States and Japan.

EBITDA before special items of Pharmaceuticals rose by 10.1 percent to 1.500 billion euros. The robust increase in earnings was primarily attributable to higher demand and a decrease in the cost of goods sold. In addition, research and development expenses were down compared with the high level of the prior-year period and because the recognition of study costs is being phased differently than in 2018. Negative currency effects diminished earnings by 30 million euros.

Consumer Health posts increase in sales and earnings

Sales of self-care products (Consumer Health) rose by 2.1 percent (Fx & portfolio adj.) to 1.442 billion euros. The division recorded the strongest growth in Latin America, while business also expanded in Europe/Middle East/Africa and in Asia/Pacific. North America was the only region in which sales were down slightly on a currency- and portfolio-adjusted basis. On a global level, the Allergy & Cold category delivered the strongest performance, with sales climbing by 10.8 percent (Fx & portfolio adj.). The division also recorded encouraging growth in the Digestive Health and Nutritionals categories, which saw sales increase by 7.9 percent and 4.0 percent, respectively, after adjusting for currency and portfolio effects. By contrast, sales declined by 4.2 percent (Fx & portfolio adj.) in the Dermatology category and by 3.2 percent (Fx & portfolio adj.) in the Pain & Cardio category.

EBITDA before special items of Consumer Health increased by 5.5 percent to 270 million euros. Positive contributions to earnings came primarily from the efficiency program initiated at the end of 2018, which led to a significant decrease in selling expenses, as well as from sales growth. Earnings were diminished by the absence of the contribution from the divested U.S. prescription dermatology business.

Animal Health sees business decline slightly following strong prior-year quarter

Sales of Animal Health fell by 2.7 percent (Fx & portfolio adj.) to 454 million euros, due especially to volumes declining substantially in the United States as expected following a strong prior-year quarter. The positive developments in Asia/Pacific and Latin America did not fully offset this effect. EBITDA before special items declined by 3.1 percent to 124 million euros.

Outlook for 2019 confirmed yet increasingly ambitious

Bayer has confirmed its outlook for the Group and its segments for fiscal 2019. However, this outlook is becoming increasingly ambitious in view of the challenging environment for the Crop Science business. For 2019, the company expects Group sales to amount to around 46 billion euros based on 2018 exchange rates. This corresponds to an increase of approximately 4 percent (Fx & portfolio adj.). Bayer is aiming for a currency-adjusted increase in EBITDA before special items to approximately 12.2 billion euros, while core earnings per share are seen rising to approximately 6.80 euros based on 2018 exchange rates. These targets do not take into account the plans to exit the Animal Health business unit, the agreed divestment of the Consumer Health brands Coppertone™ and Dr. Scholl’s™, and the planned sale of the 60-percent interest in German site services provider Currenta.

For more information go to www.bayer.com.

Forward-Looking Statements

This release may contain forward-looking statements based on current assumptions and forecasts made by Bayer management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Bayer’s public reports which are available on the Bayer website at www.bayer.com. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.