Bayer increases sales and earnings – leader in agriculture after acquisition

-

Group sales advance 4.5 percent (Fx & portfolio adj.) to 39.586 billion euros

-

EBITDA before special items increases by 2.8 percent to 9.547 billion euros, held back by currency effects of 457 million euros

-

Pharmaceuticals posts higher sales (Fx & portfolio adj.) and slightly lower earnings

-

Consumer Health: sales level with prior year (Fx & portfolio adj.), earnings decline

-

Crop Science reports sales gains, substantially higher earnings due to the acquisition, integration off to a strong start

-

Positive safety profile of glyphosate unchanged - Bayer vigorously defending itself against lawsuits

-

Net income at 1.695 billion euros, impacted by one-time effects

-

Core earnings per share at 5.94 euros, above expectations

-

Net financial debt at 35.679 billion euros, significantly better than expected

-

Bayer confirms 2019 Group outlook and 2022 targets

Leverkusen, February 27, 2019 – Bayer successfully completed the largest acquisition in its history and attained its operational targets in 2018. “We have set the right course for the future,” said Werner Baumann, Chairman of the Board of Management, on Wednesday at the Financial News Conference in Leverkusen. Group sales and earnings increased in 2018. Adjusted for currency and portfolio effects (Fx & portfolio adj.), the Crop Science and Pharmaceuticals divisions registered higher sales year on year, while sales of Consumer Health were level with the prior year. Bayer has confirmed its outlook for 2019 and the targets for 2022.

“Over recent years we have systematically developed into a focused life science company, clearly aligned to the megatrends in health and agriculture and united under the strong umbrella brand Bayer,” Baumann said. “The acquisition in agriculture has lifted us to the number one position in this market. The integration of the two companies has gotten off to an excellent start.”

Another important step taken last year was the decision, announced in late November, to strengthen the company through a series of portfolio, efficiency and structural measures. “These will make us more focused, more effective, more agile and more competitive,” said Baumann. The portfolio measures include in particular the decision to exit the Animal Health business unit and the Consumer Health brands Coppertone™ and Dr. Scholl’s™. Bayer also plans to sell its 60-percent interest in German site services provider Currenta.

“In 2018, we were again able to increase sales and earnings, despite encountering a challenging market and currency environment,” Baumann said. Group sales increased by 4.5 percent (Fx & portfolio adj.) to 39.586 billion euros. On a reported basis, sales were up by 13.1 percent. EBITDA before special items rose by 2.8 percent to 9.547 billion euros, although negative currency effects diminished earnings of the pre-acquisition Bayer businesses by 457 million euros. EBIT decreased by 33.7 percent to 3.914 billion euros after special charges of 2.566 billion euros (2017: 1.227 billion euros). These mainly resulted from impairment losses (around 3.3 billion euros) or from special charges in connection with the acquired business (around 2.0 billion euros). These charges were partly offset by a one-time special gain from divestments of around 4.1 billion euros.

Net income declined by 76.9 percent to 1.695 billion euros, due in part to the prior-year figure including a gain in connection with the deconsolidation of Covestro. Core earnings per share from continuing operations were above expectations, at 5.94 euros (minus 10.5 percent). The year-on-year decrease was due to portfolio changes and financing activities, with the financing costs for the Monsanto acquisition standing against the earnings contribution from the acquired business, which was lower for seasonal reasons. In addition, the number of Bayer shares increased substantially as a result of the equity measures implemented in the second quarter of 2018.

Free cash flow increased by 17.4 percent to 4.652 billion euros. Net financial debt rose by around 32 billion euros year on year to 35.679 billion euros as of December 31, 2018. “Following the increase due to the Monsanto acquisition, we are pleased to have already reduced our debt faster than anticipated,” said Chief Financial Officer Wolfgang Nickl.

Pharmaceuticals increases sales (Fx & portfolio adj.), with especially strong growth in China

Sales of prescription medicines (Pharmaceuticals) rose by 3.4 percent (Fx & portfolio adj.) to 16.746 billion euros. “This was mainly due to substantial growth in China and the continued strong performance of our key growth products overall,” said Baumann. Sales of the oral anticoagulant Xarelto™, the eye medicine Eylea™, the cancer drugs Stivarga™ and Xofigo™, and the pulmonary hypertension treatment Adempas™ advanced by 13.5 percent (Fx & portfolio adj.) to 6.838 billion euros. Business with Xarelto™ increased by 12.8 percent (Fx & portfolio adj.), primarily due to higher volumes in Europe, China and Canada. Sales of Eylea™ advanced by 19.6 percent (Fx & portfolio adj.), buoyed by higher volumes in Europe, Japan and Canada. Adempas™ registered the strongest increase in sales, at 24.1 percent (Fx & portfolio adj.), driven by expanded volumes in the United States. Sales of Xofigo™ declined by 10.3 percent (Fx & portfolio adj.), mainly due to lower demand in the United States and Europe.

The strongest growth among the other top Pharmaceuticals products was recorded for the diabetes treatment Glucobay™. Sales were up by 13.8 percent (Fx & portfolio adj.) due to a robust expansion of volumes in China. By contrast, sales of the multiple sclerosis treatment Betaferon™/Betaseron™ declined by 13.0 percent (Fx & portfolio adj.) as a result of the competitive market environment in the United States. In addition, temporary supply disruptions for some of the division’s established products, such as Adalat™ and Aspirin™ Cardio, weighed on sales, as expected.

EBITDA before special items of Pharmaceuticals decreased by 2.0 percent to 5.598 billion euros. However, earnings were up by 2.5 percent after adjusting for currency effects (Fx adj.), primarily due to a substantial expansion in volumes – especially for Xarelto™ and Eylea™ – and to income of approximately 190 million euros from a development collaboration with a Johnson & Johnson subsidiary. Earnings were mainly held back by an increase in the cost of goods sold, the effects of temporary supply disruptions and higher selling expenses.

Consumer Health increases sales (Fx & portfolio adj.) in Latin America and Asia/Pacific

Sales of Consumer Health were level year on year, at 5.450 billion euros (Fx & portfolio adj.: minus 0.7 percent). “2018 was a difficult year for our business with nonprescription medicines. We initiated a series of strategic measures in order to achieve success in this rapidly changing market environment,” Baumann said. Business was up in Latin America and Asia/Pacific on a currency- and portfolio-adjusted basis. By contrast, sales declined in North America and in Europe/Middle East/Africa. Temporary supply difficulties held back sales at Consumer Health too, as expected.

Business with the prenatal vitamin Elevit™ expanded by 16.9 percent (Fx & portfolio adj.), primarily due to continued strong demand and product line extensions in the Asia/Pacific and Europe/Middle East/Africa regions. The division also registered sales gains for its MiraLAX™ product to treat occasional constipation (Fx & portfolio adj.: plus 12.4 percent) and for the Bepanthen™/Bepanthol™ wound and skin care products (Fx & portfolio adj.: plus 3.0 percent). Sales of the antihistamine Claritin™ were down 6.3 percent (Fx & portfolio adj.) year on year, mainly due to business in the United States, the primary sales market, which was impacted by the weak season in this market segment and by intensified competition. Sales of the Canesten™ skin and intimate health products decreased by 8.2 percent (Fx & portfolio adj.) as a result of temporary supply disruptions.

EBITDA before special items of Consumer Health declined by 11.0 percent to 1.096 billion euros. Adjusted for currency effects, earnings were 5.5 percent lower than in 2017. The decrease was primarily attributable to lower volumes and a decrease in one-time gains that predominantly related to the divestment of non-core brands. A decline in selling and general administration expenses only partly offset these effects.

Crop Science substantially increases sales and earnings thanks to acquisition

In the agricultural business (Crop Science), Bayer registered sales of 14.266 billion euros. The acquired business accounted for around 5.3 billion euros of this figure, while the businesses divested to BASF contributed 1.5 billion euros prior to the closing of the respective transactions in August 2018. The 6.1-percent increase on a currency- and portfolio-adjusted basis largely resulted from the normalization of crop protection inventories in Brazil, where business in the prior year had been impacted by the required measures in this context. Sales were also up (Fx & portfolio adj.) in the Asia/Pacific and North America regions. Bayer also benefited from service agreements – especially product supply and distribution agreements – with BASF in connection with the divested businesses. In Europe, sales were down due to unfavorable weather conditions and regulatory changes affecting certain SeedGrowth products in France.

On a pro-forma basis, with sales presented as if the acquisition of Monsanto and the associated divestments had already taken place as of January 1, 2017, sales of Crop Science increased by 3.1 percent (Fx adj.) thanks to growth at Herbicides, Fungicides, Insecticides and Corn Seed & Traits, while business at Soybean Seed & Traits matched the prior-year level. By contrast, sales decreased at Environmental Science, mainly due to the planned lower product deliveries to the acquirer of the consumer business divested in 2016.

EBITDA before special items of Crop Science advanced by 29.8 percent to 2.651 billion euros. This increase is partly attributable to the earnings contribution from the newly acquired business (705 million euros) and the recognition in the second quarter of 2017 of significantly higher provisions for product returns in Brazil. This stood against the prior-year prorated earnings contribution from the businesses divested to BASF. Earnings were also held back by a decrease in volumes in Europe and a negative currency effect of 101 million euros for the pre-acquisition Bayer businesses.

As of January 28, 2019, lawsuits from approximately 11,200 plaintiffs had been served in the United States in connection with the crop protection product glyphosate. “We disagree with the ruling by a court of first instance in the Johnson case and have therefore filed an appeal,” Baumann said. Also in respect of further proceedings, seven of which are currently scheduled for this year, he added: “We have the science on our side and will continue to vigorously defend this important and safe herbicide for modern and sustainable farming.”

Animal Health grows (Fx & portfolio adj.) in three out of four regions

Sales of Animal Health came in at 1.501 billion euros in 2018, matching the prior-year level (Fx & portfolio adj.: plus 0.5 percent). Business expanded (Fx & portfolio adj.) in all regions except Europe/Middle East/Africa. Sales of the Seresto™ flea and tick collar increased by a substantial 28.5 percent (Fx & portfolio adj.), while business with the Advantage™ family of flea, tick and worm control products was down by 9.3 percent (Fx & portfolio adj.) year on year. EBITDA before special items declined by 6.0 percent to 358 million euros. However, adjusted for currency effects, earnings matched the prior-year level (plus 0.8 percent). An increase in the cost of goods sold and a negative impact on sales and earnings from the application of new financial reporting standards (IFRS 15) were offset by lower selling expenses and other factors.

Bayer confirms short- and medium-term growth targets

Bayer has confirmed the forecasts for 2019 and the medium-term targets for 2022 that it provided in conjunction with its Capital Markets Day on December 5, 2018. For 2019, the company expects sales to amount to around 46 billion euros. This corresponds to an increase of approximately 4 percent (Fx & portfolio adj.). Bayer aims to increase EBITDA before special items to approximately 12.2 billion euros (Fx adj.), while core earnings per share are seen rising to approximately 6.80 euros (Fx adj.). These targets do not take into account changes in exchange rates or the plans to exit the Animal Health business unit, divest the Consumer Health brands Coppertone™ and Dr. Scholl’s™, and sell the 60-percent interest in German site services provider Currenta.

For Crop Science, Bayer sees 2019 sales rising by around 4 percent (Fx & portfolio adj.) and anticipates an EBITDA margin before special items of approximately 25 percent. For Pharmaceuticals, Bayer expects sales to rise by approximately 4 percent (Fx & portfolio adj.) and the EBITDA margin before special items to increase to around 34 percent. For Consumer Health, the company aims to increase sales by approximately 1 percent (Fx & portfolio adj.) and to achieve an EBITDA margin before special items of around 21 percent. For Animal Health, Bayer also expects sales to increase by around 4 percent (Fx & portfolio adj.) and aims to achieve an EBITDA margin before special items of approximately 24 percent.

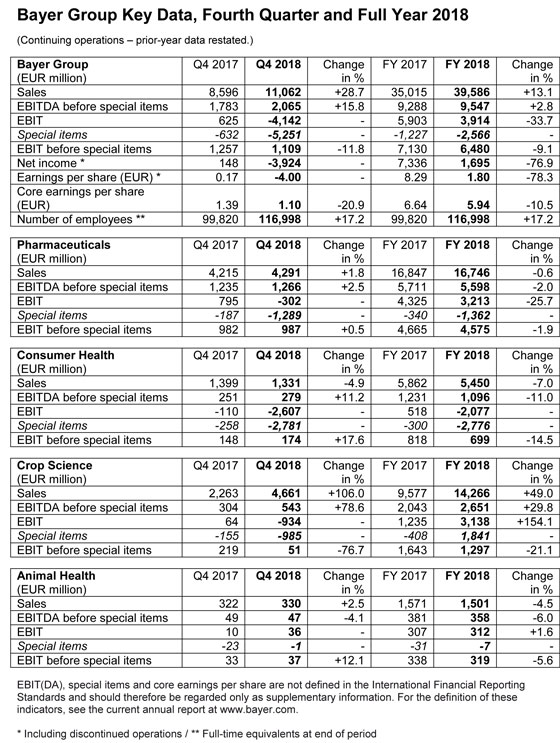

Bayer Group Key Data, Fourth Quarter and Year 2018

(Continuing operations - prior-year data restated.)

For more information, go to www.bayer.com.

Forward-Looking Statements

This release may contain forward-looking statements based on current assumptions and forecasts made by Bayer management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Bayer’s public reports which are available on the Bayer website at www.bayer.com. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.