Bayer: Good start to 2020 – activities marked by COVID-19

-

Employee safety and business continuity are top priorities

-

Wide-ranging humanitarian and social engagement

-

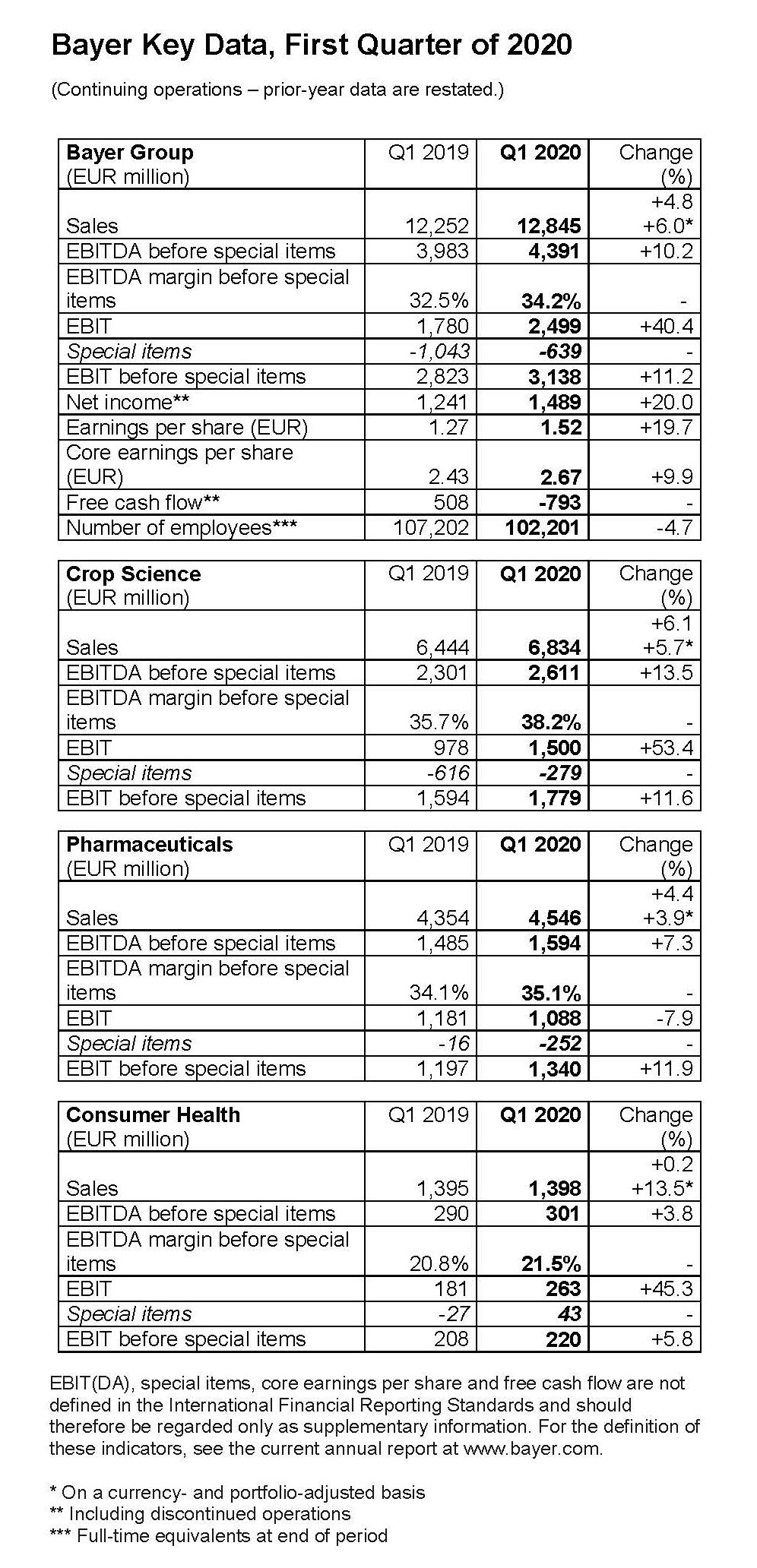

Group sales increase by 6.0 percent (Fx & portfolio adj.) to 12.845 billion euros

-

EBITDA before special items up by 10.2 percent to 4.391 billion euros

-

All divisions report higher sales and earnings – strong demand at Consumer Health

-

Net income advances by 20.0 percent to 1.489 billion euros

-

Core earnings per share increase by 9.9 percent to 2.67 euros

-

Outlook for 2020: impact of COVID-19 not yet reliably quantifiable

Leverkusen, April 27, 2020 – The Bayer Group has registered a good start to 2020, with business activities in the first quarter greatly marked by the COVID-19 pandemic. “With our life science product portfolio in the areas of health and nutrition, we have shown our ability to successfully continue our business operations in a challenging environment and deliver a positive contribution for our stakeholders even during a time of crisis,” Werner Baumann, Chairman of the Board of Management, said on Monday when presenting the company’s quarterly statement. Bayer has implemented extensive measures at its sites in a bid to halt or at least slow the spread of COVID-19. “The health and safety of our employees is our top priority. We are also focused on ensuring that patients, farmers and consumers receive our products, especially our life-saving medicines,” Baumann said.

While the COVID-19 pandemic led to higher demand – partly due to inventory buildup – and thus an increase in sales at some business units, the restrictions related to the pandemic are adversely impacting parts of the company’s business. Bayer has provided substantial support in areas affected by COVID-19, such as through donations of money, medicines and medical supplies and the provision of testing equipment from its laboratories, complemented by exceptional efforts on the part of its employees.

Group sales in in the first quarter of 2020 rose by 6.0 percent on a currency- and portfolio-adjusted basis (Fx & portfolio adj.) to 12.845 billion euros. EBITDA before special items increased by 10.2 percent to 4.391 billion euros, and included positive currency effects of 41 million euros. EBIT advanced by 40.4 percent to 2.499 billion euros, in part due to a decline in net special charges to 639 million euros (Q1 2019: 1.043 billion euros). These special charges primarily related to legal fees, ongoing restructuring programs and the integration of Monsanto. Net income increased by 20.0 percent to 1.489 billion euros, while core earnings per share from continuing operations rose by 9.9 percent to 2.67 euros.

Free cash flow amounted to minus 793 million euros (Q1 2019: plus 508 million euros). The decrease was mainly attributable to the lower operating cash flow caused by changes in working capital, especially in the Crop Science Division, resulting partly from a shift between the reporting periods that adversely impacted the first quarter of 2020. This was due to a comparatively early decline in trade accounts receivable at the end of 2019 and the settling of a comparatively large amount of trade payables in the first quarter of 2020. Net financial debt as of March 31, 2020, at 35.399 billion euros, was 3.9 percent higher than at year-end 2019, mainly as a result of cash outflows from operating activities and negative currency effects.

Crop Science sees especially strong growth at Insecticides and Fungicides

In the agricultural business (Crop Science), Bayer increased sales by 5.7 percent (Fx & portfolio adj.) to 6.834 billion euros, with all regions registering growth. Sales at Corn Seed & Traits advanced by 9.8 percent (Fx & portfolio adj.). The unit benefited from advance demand in Europe/Middle East/Africa and an anticipated substantial increase in acreages in North America, while higher volumes in Brazil and Mexico in particular lifted sales in Latin America. Insecticides reported particularly strong growth (Fx & portfolio adj. 15.4 percent), as did Fungicides (Fx & portfolio adj. 14.0 percent). In North America and Europe/Middle East/Africa, in particular, the Insecticides business benefited from a good start to the season in the respective countries and advance product purchases. At Fungicides, business improved in Europe/Middle East/Africa following a weak prior-year quarter. Sales in North America benefited from higher volumes in the United States, while business in Latin America was supported by the market launch of Fox Xpro™ in Brazil in the prior year. Declines were primarily recorded at Vegetable Seeds (Fx & portfolio adj. 13.5 percent), with business mainly down in North America due to shifts in demand into the previous quarter and the impact of COVID-19. At Soybean Seed & Traits, sales were down against the prior-year quarter (Fx & portfolio adj. minus 7.6 percent). Declines in North America due in part to lower selling prices were only partially offset by strong sales gains in Latin America.

EBITDA before special items at Crop Science rose by 13.5 percent to 2.611 billion euros. The increase was primarily attributable to advance demand due to COVID-19, higher volumes in all regions and the realization of cost synergies as the integration of the acquired business progressed.

As of April 14, 2020, lawsuits involving approximately 52,500 plaintiffs had been served in the United States in connection with the glyphosate-based Roundup™ products. This number does not reflect the merits of the alleged claims. Bayer continues to engage constructively in the mediation process and had made progress before the outbreak of COVID-19 and the global pandemic significantly slowed the mediation process. The company will continue to consider a solution only if it is financially reasonable and puts in place a mechanism to resolve potential future claims efficiently. Against the background of a looming recession and looking at, in part, considerable liquidity challenges, this applies now more than ever, Baumann said.

Pharmaceuticals increases sales and earnings

Sales of prescription medicines (Pharmaceuticals) rose by 3.9 percent (Fx & portfolio adj.) to 4.546 billion euros. Business was impacted by the implementation of new tender procedures in China as well as the spread of the COVID-19 pandemic and the related effects on medical care and ordering behavior.

Sales of the oral anticoagulant Xarelto™ increased by 18.8 percent (Fx & portfolio adj.), mainly due to higher volumes in Europe/Middle East/Africa resulting, among other things, from changes in ordering behavior due to the COVID-19 pandemic. The operational business also continued to grow in China and Russia. Business with the pulmonary hypertension treatment Adempas™ rose by 26.5 percent (Fx & portfolio adj.), primarily due to continued volume growth in the United States. The company also registered significant sales gains for its cancer drug Stivarga™ (Fx & portfolio adj. 23.8 percent), primarily as a result of higher volumes in China, the United States and Russia. Sales of the eye medicine Eylea™ were up by 1.1 percent (Fx & portfolio adj.) year on year. Declines caused by a change in ordering behavior due to imminent price reductions in Japan and France were offset by sales gains in the United Kingdom, Germany and Canada. Sales of the diabetes treatment Glucobay™ declined by 38.2 percent (Fx & portfolio adj.) due to a sharp decrease in business in China. This resulted from restrictions in connection with COVID-19 and the significant price reductions anticipated with the introduction of the country’s volume-based procurement policy.

EBITDA before special items at Pharmaceuticals advanced by 7.3 percent to 1.594 billion euros, primarily due to the good development of business.

Consumer Health grows business in all regions

Sales of self-care products (Consumer Health) increased by 13.5 percent (Fx & portfolio adj.) to 1.398 billion euros. The strong growth is primarily attributable to a substantial increase in demand due to the COVID-19 pandemic, partly for inventory buildup. The division was able to respond very flexibly to significantly higher volumes and shifts in the product mix thanks to its supply chain operation. Sales rose in all regions and categories on a currency- and portfolio-adjusted basis. Growth was strongest in the Nutritionals (Fx & portfolio adj. 33.7 percent) and Pain & Cardio (Fx & portfolio adj. 19.6 percent) categories.

EBITDA before special items at Consumer Health increased by 3.8 percent to 301 million euros. This was driven by substantial growth in sales and positive effects of the efficiency program launched in late 2018, which more than compensated for the absence of earnings from the businesses divested in 2019 and higher marketing expenses.

Impact of COVID-19 on outlook cannot be reliably assessed at this time

The forecast published in February 2020 did not take into account the effects of the COVID-19 pandemic and continues to reflect the company’s targets. Bayer anticipates that, following the positive start to the year, COVID-19 will continue to impact its business over the course of 2020. It will not be possible to reliably assess the positive and negative effects until later in the year.

The key factors that will have a major impact on the development of Bayer’s business are as follows:

- Production and supply: stability of the entire supply chain, inventory/safety stock, logistics (including impact on costs)

- Demand dynamics: demand patterns (e.g. stockpiling), impact on elective treatments, biofuel demand and seasonal labor, clinical trials and regulatory processes

- Financial markets: Debt market access/interest rates, payment behavior of customers and solvency of suppliers, Fx volatility

- Trends/opportunities: Cost management, acceleration of digitalization, role of science in society

For more information go to www.bayer.com.

Forward-Looking Statements

This release may contain forward-looking statements based on current assumptions and forecasts made by Bayer management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include those discussed in Bayer’s public reports which are available on the Bayer website at www.bayer.com. The company assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments.